Simply put, Foreign Exchange (forex or FX) is when someone trades one currency for another. A simple example can be is when a person swaps the US Dollar for the Euro. I know it sounds boring, but here’s the interesting part, if you forecast that one currency will be stronger versus another, and your prediction ends up on point, then you can make a profit and you buy yourself a nice fancy dinner.

Each and every country in the world has its own economy and therefore its own currency of exchange. People who live in the European Union use the Euros as their exchange currency. People who live in the United States use the US Dollar as their form of exchange. The Japanese use the Yen, the Chinese use the Yuan… I think you got the point!

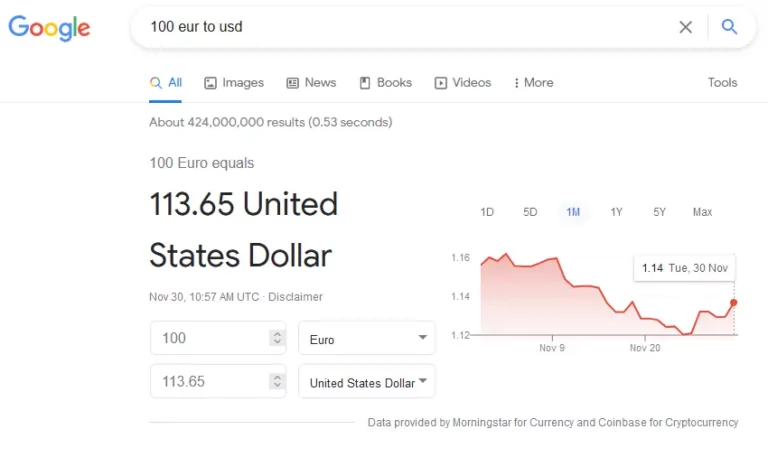

Now let’s say you want to exchange two currencies from two different countries. First, you have to check what is the relative price of the two currencies, which is called the exchange rate. For example, if you want to exchange €100 to US Dollars at today’s exchange rate, a quick Google search will show you how much your €100 is equivalent in US Dollars. So, in this case, you will get $113.65 for your €100. That means, today the Euro is more valuable than the USD. Tomorrow, the exchange rate can change and the value of the Euro against the US dollars can either increase or decrease.

The way to make money with forex is by taking advantage of these market fluctuations. But in order to do that, you need first to understand what, why, how and who moves this market?

The next step will be for you to develop the necessary forecasting and trading skills before capitalizing on the limitless opportunities.

But don’t worry! We will cover everything you need to know about Forex and trading in this LOOOONG but easy-to-follow guide.

So, let’s start from the beginning…

The way to make money with forex is by taking advantage of these market fluctuations. But in order to do that, you need first to understand what, why, how and who moves this market?

The next step will be for you to develop the necessary forecasting and trading skills before capitalizing on the limitless opportunities.

But don’t worry! We will cover everything you need to know about Forex and trading in this LOOOONG but easy-to-follow guide.

So, let’s start from the beginning…

What is forex? (With more technical words this time)

The foreign exchange market, also known as “forex” or “FX”, is the LARGEST decentralized global financial market where the world’s currencies change hands by the millisecond.

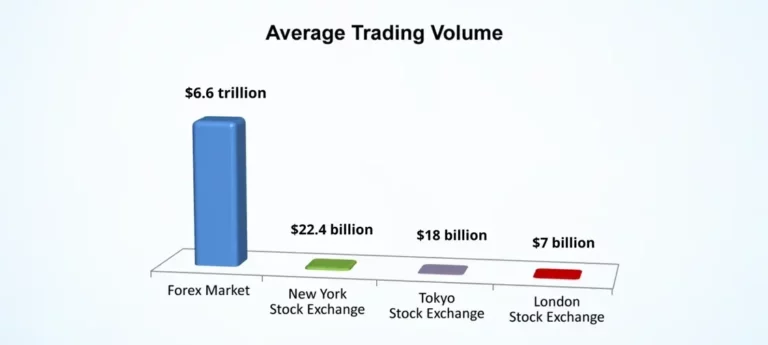

The forex market has a whopping of $6.6 TRILLION of daily trading volume, much bigger than the “tiny” $22.4 billion daily volume of the New York Stock Exchange (NYSE). When we said the LARGEST, we really meant it.

Check out the graph of the average daily trading volume for the forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange:

With a gigantic $6.6 trillion number, the currency market clearly stands out from the rest of the stock exchanges. However, the “spot” market, which is the part of the currency market that’s relevant to most forex traders is smaller at $2 trillion per day, which is still much bigger than any other stock exchange.

And then, there is the daily trading volume from retail traders, which is estimated to be around 3-5% of overall daily FX trading volumes, or around $200-300 billion. Which is again, much bigger than any other stock exchange.

Aside from its size, the FX market doesn’t sleep! It is open 24 hours a day and 5 days a week. Money never sleeps, well except in the weekends maybe. But, unlike the stock or bond markets, the forex market does NOT close at the end of each business day.

Instead, trading just shifts to different financial markets around the world.

The trading day starts when traders wake up in Wellington, then moves to Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and finally, New York, before trading starts all over again in New Zealand!

In the next section, we’ll reveal WHAT exactly is traded in the forex market.

1. What Is Traded in Forex?

What is that ONE thing that we all desire? That ONE thing that solves 99% of all of our problems?

MONEY!

In the FX market, money, specifically currencies of all kind, are traded with each other.

Before all the current technological advancements that we are currently living in, traders used go to a physical place and exchange their currencies with other people, in person.

Today, everything is virtual and fast. You buy and sell with a press of a button, right from the comfort of your home. Online FX brokers, such as ourselves, will provide you the access to the forex market.

“But wait a minute! What do you mean by virtual? Do you mean I do not buy them physically?”

We know this might sound confusing at first, so we are going to put things in the simplest way.

If you remember in the previous lesson, we said that every country has its own economy and currency. The better the economy, the stronger the currency. So, think of forex trading like investing in countries. When you buy a specific currency against another, for example the Euro vs the US Dollar, you are investing in the European Union’s economy and anticipating a better economic performance against the United States.

As time goes by and your market analysis proves to be on point, you sell the euro back to the market, and you will end up with a profit.

HINT: The exchange rate of two currencies shows the relative economic strength between two countries.

Major Currencies

As we said before, the forex market contains every kind of currencies for you to trade, but as a new trader, we recommend starting with the major currencies.

Why “major currencies” and what are they?

Major currencies represent some of the world’s largest economies as a result, they are the most heavily traded currencies.

Below, we list them by their symbol, country where they are used, currency name, and nicknames.

Currency symbols are always represented as three letters, where the first two letters represent the name of the country and the third letter identifies the name of that country’s currency, usually the first letter of the currency’s name.

These three letters are known as ISO 4217 Currency Codes.

Why three letters? Well in 1973, the International Organization for Standardization (ISO) established the three-letter codes for currencies that we use today.

Take USD for instance…

US stands for United States, while D stands for dollar.

Simple, right?

DID YOU KNOW?

The British pound is the world’s oldest currency that is still in use, dating back to the 8th century.

Latest Blogs

What is Forex ?

Simply put, Foreign Exchange (forex or FX) is when someone trades one currency for another.

Introduction to CFD Trading

What are CFDs in Forex Trading Before you begin with your CFD trading journey, first

Can You Automate Crypto Trading?

Crypto Traders Rejoice! If you are looking for a platform to automate your crypto trading